SCHD (Schwab U.S. Dividend Equity ETF) has confirmed its Q2 2025 dividend at $0.2602 per share!

While the stock price hasn't fully participated in the recent market rally, SCHD continues to show solid performance in terms of dividend growth. Let's dive into the latest developments and investment appeal of SCHD that dividend investors should know about.

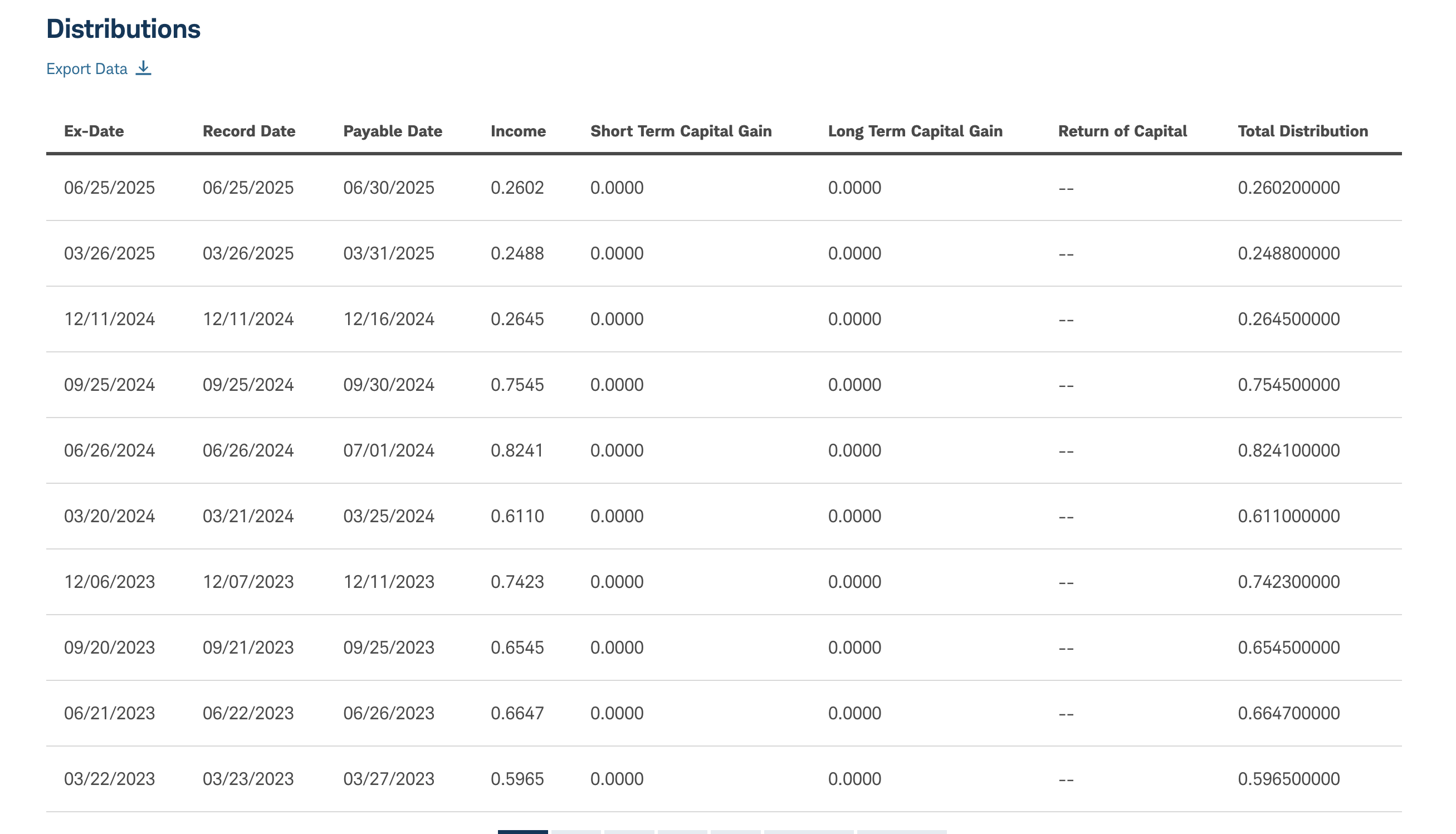

📊 Q2 2025 Dividend Details

Dividend Information

- Dividend: $0.2602 (+4.58% increase from previous quarter's $0.2488)

- Ex-Dividend Date: June 25, 2025

- Payment Date: June 30, 2025

- Annualized Dividend Yield: Approximately 3.3% (based on stock price of $26.75 as of June 24, 2025)

Dividend Growth Trend

SCHD Quarterly Dividend Growth Trend

SCHD Quarterly Dividend Growth Trend

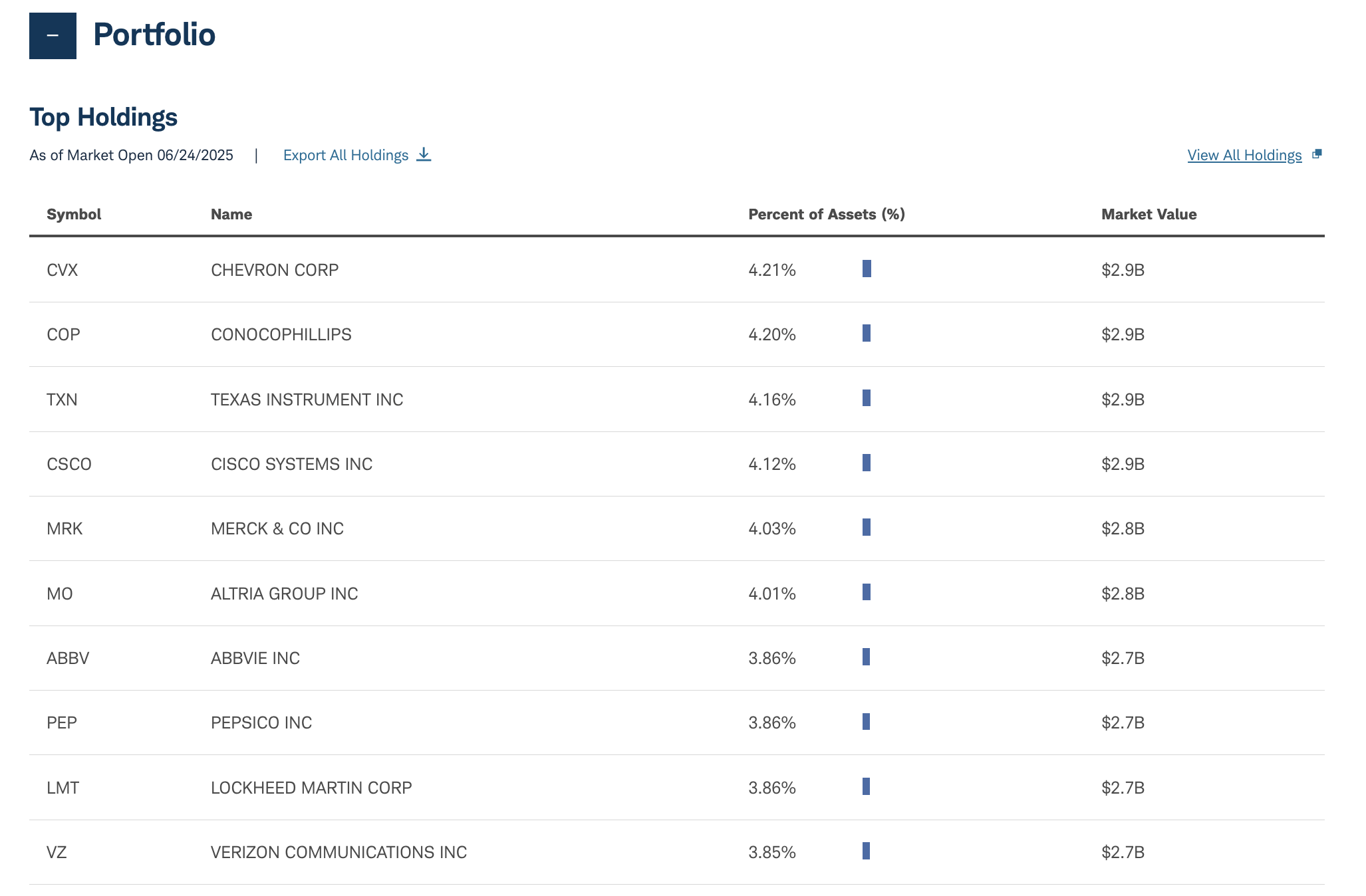

🏢 Portfolio Composition

Top 10 Holdings (as of June 24, 2025)

SCHD Top 10 Holdings

SCHD Top 10 Holdings

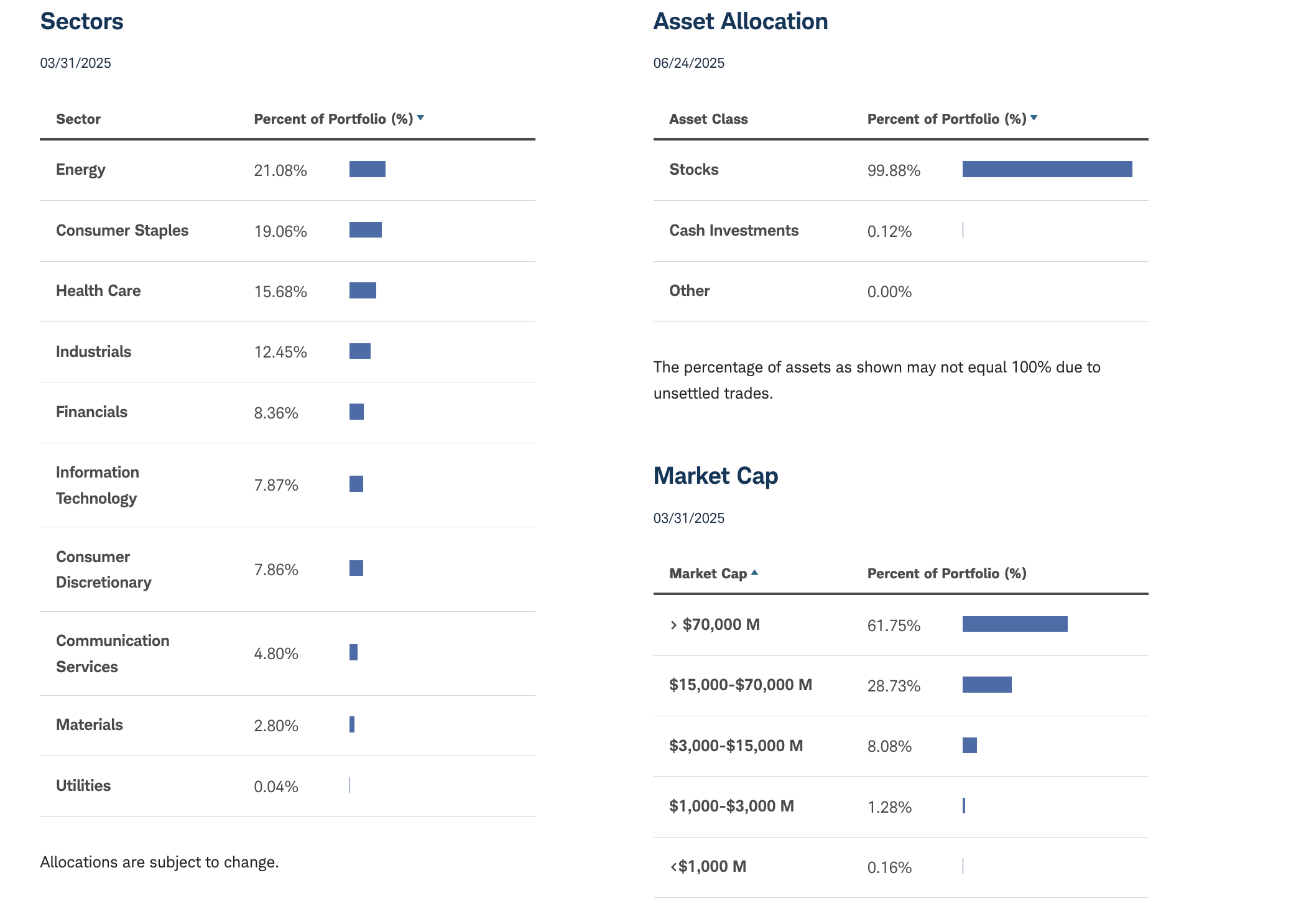

Sector Allocation

SCHD Sector Distribution

SCHD Sector Distribution

📈 Performance Analysis vs Market

Recent Returns Comparison

SCHD vs Market Returns Comparison

SCHD vs Market Returns Comparison

💡 Investment Analysis: Solid Dividend Growth Despite Market Underperformance

🔹 Positive Factors

- Consistent Dividend Growth: Q2 dividend increased 4.58% quarter-over-quarter, maintaining growth momentum

- Attractive Dividend Yield: Currently offering approximately 3.3% yield

- Robust Portfolio: Concentrated in stable sectors like Energy, Consumer Staples, and Healthcare

- Low Expense Ratio: Efficient investing with just 0.06% annual fee

🔸 Areas of Concern

- Underperforming Market: YTD -3.35%, trailing market averages

- Sector Concentration: Heavy weighting in Energy (21.08%) and Consumer Staples (19.06%)

- Growth Stock Underperformance: Relatively overlooked in recent tech-led market rally

While SCHD hasn't kept pace with short-term market gains, it continues to provide steady returns through stable dividend growth and a solid portfolio from a long-term perspective.

🎯 Investment Strategy Recommendations

Suitable for Long-term Dividend Investors

- Dollar-Cost Averaging: Regular monthly investments regardless of market volatility to lower average cost basis

- Dividend Reinvestment: Maximize compound returns by reinvesting dividends

- Portfolio Diversification: Combine SCHD with growth ETFs for a balanced portfolio approach

Investment Timing

Current relatively adjusted stock price presents a good entry point for long-term investors. The dividend yield maintaining above 3% makes it attractive for investors seeking stable cash flow.

Please carefully consider your investment objectives, risk tolerance, and investment horizon when making investment decisions.

📊 SCHD Dividend Calculator

If you're planning to invest in SCHD, try our SCHD Dividend Calculator to estimate your potential dividend income!

- Calculate annual dividend income by investment amount

- Analyze compound effects of dividend reinvestment

- Simulate returns under various scenarios

Conclusion

While SCHD hasn't fully participated in the recent market rally, its solid dividend growth and stable portfolio composition remain attractive features.

The 4.58% quarter-over-quarter increase in Q2 2025 dividend particularly demonstrates the strong fundamentals of underlying companies and SCHD management's excellent stock selection capabilities.

For investors focused on long-term dividend growth and stability rather than short-term price movements, SCHD can continue to be an important component of a core dividend portfolio.

Tags

#SCHD #DividendETF #DividendGrowth #USETF #DividendInvesting #SchwabETF #LongTermInvesting #Portfolio