Pfizer (PFE) Dividend Investment Outlook - Dividend Appeal Maintained Despite Patent Expiry and Policy Risks

Pfizer, which generated enormous profits during the COVID-19 pandemic, now faces numerous challenges. As COVID vaccine and treatment sales normalize, the stock has undergone significant correction, compounded by major drug patent expirations and U.S. government drug pricing pressure.

However, we cannot ignore Pfizer's strength in maintaining 16 consecutive years of dividend increases. Along with the current high dividend yield of 7.47%, the $43 billion Seagen acquisition to strengthen oncology business, and AI-powered drug development innovation...

Is Pfizer currently in crisis or opportunity? Let's analyze thoroughly from a dividend investor's perspective.

1. Pfizer's Current Situation: Post-Pandemic Normalization

Pfizer Overall Overview

Pfizer Overall Overview

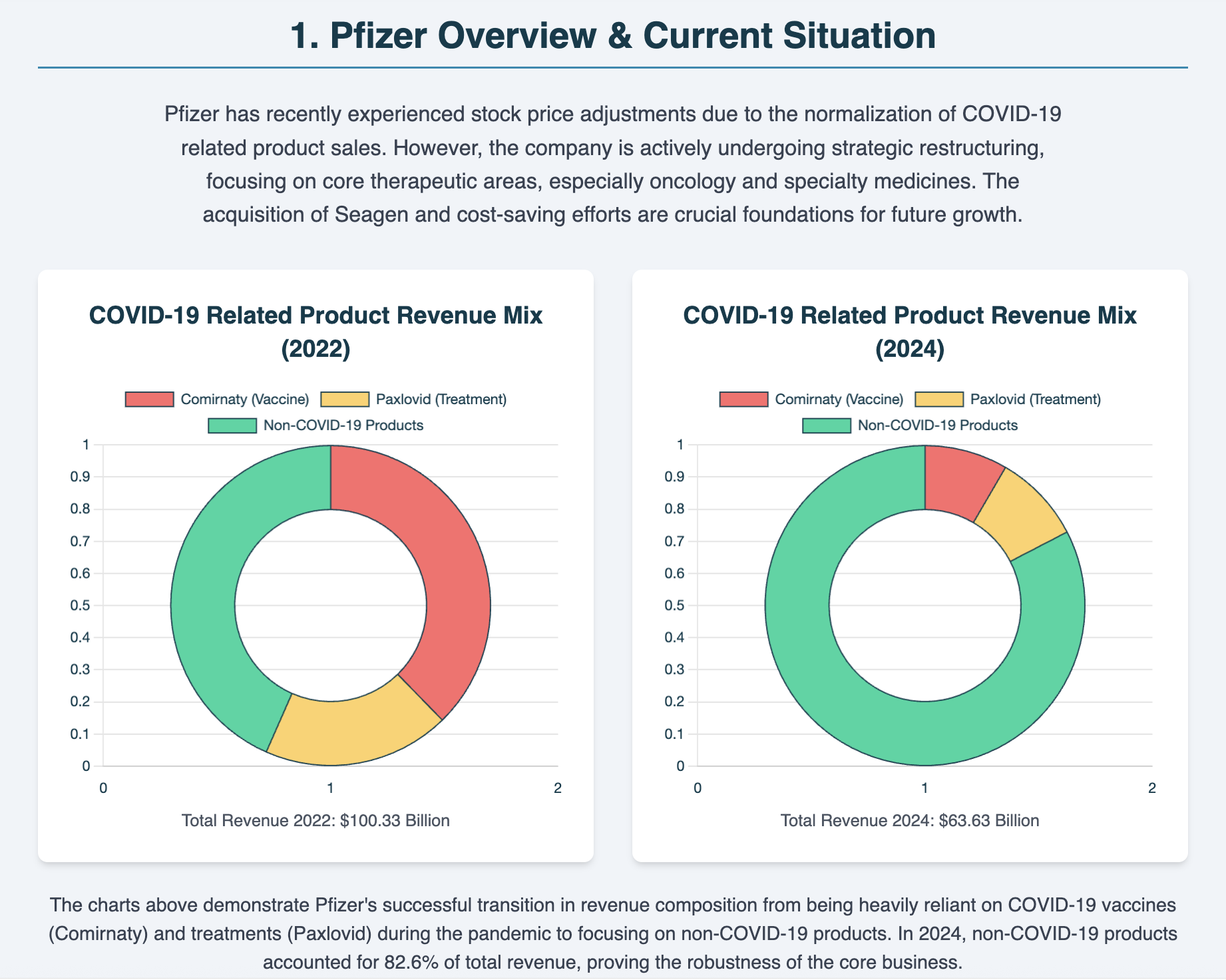

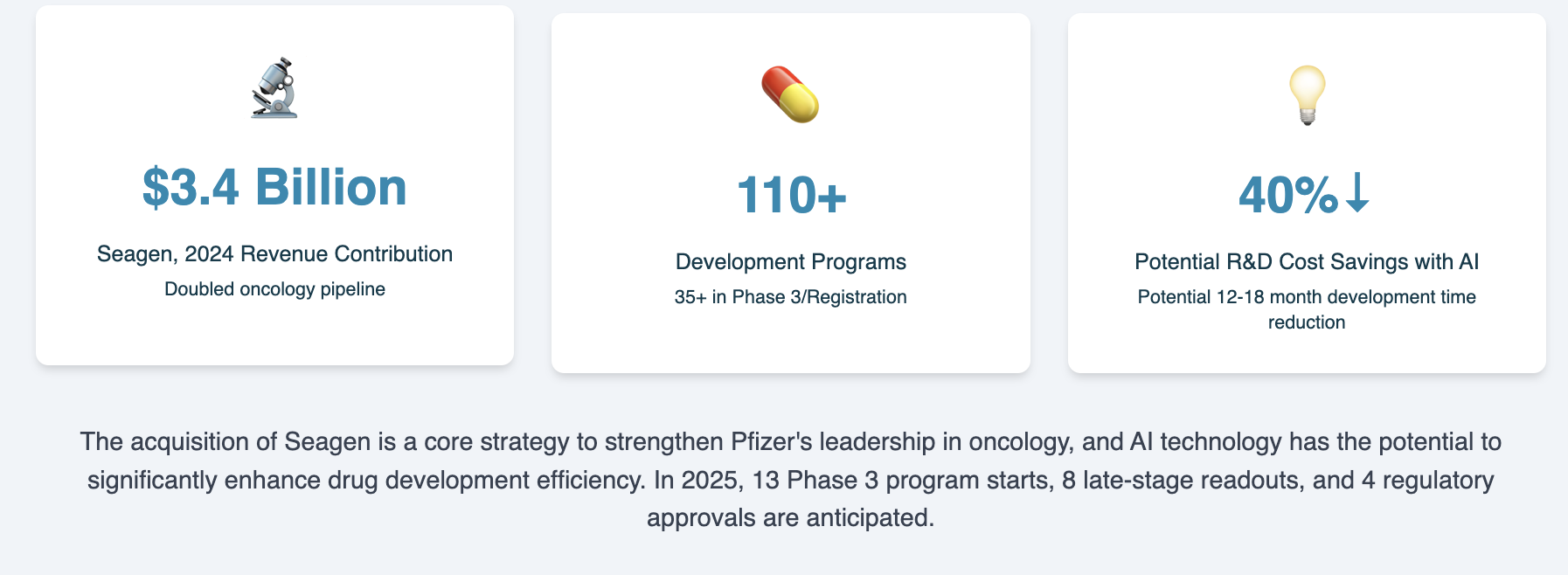

Pfizer is currently experiencing a 'post-COVID' transition period. While annual revenue exceeded $100 billion in 2021-2022 from COVID-19 vaccine (Comirnaty) and treatment (Paxlovid), it normalized to $63.6 billion in 2024.

Key Point: Solid Growth in Non-COVID-19 Business

The key is how healthy the existing business is excluding COVID-19 products:

- 2023: Non-COVID-19 revenue grew 7%

- 2024: Non-COVID-19 revenue grew 12%

This shows that Pfizer's core business continues to grow steadily regardless of pandemic-related factors.

Pfizer Revenue by Major Products

Pfizer Revenue by Major Products

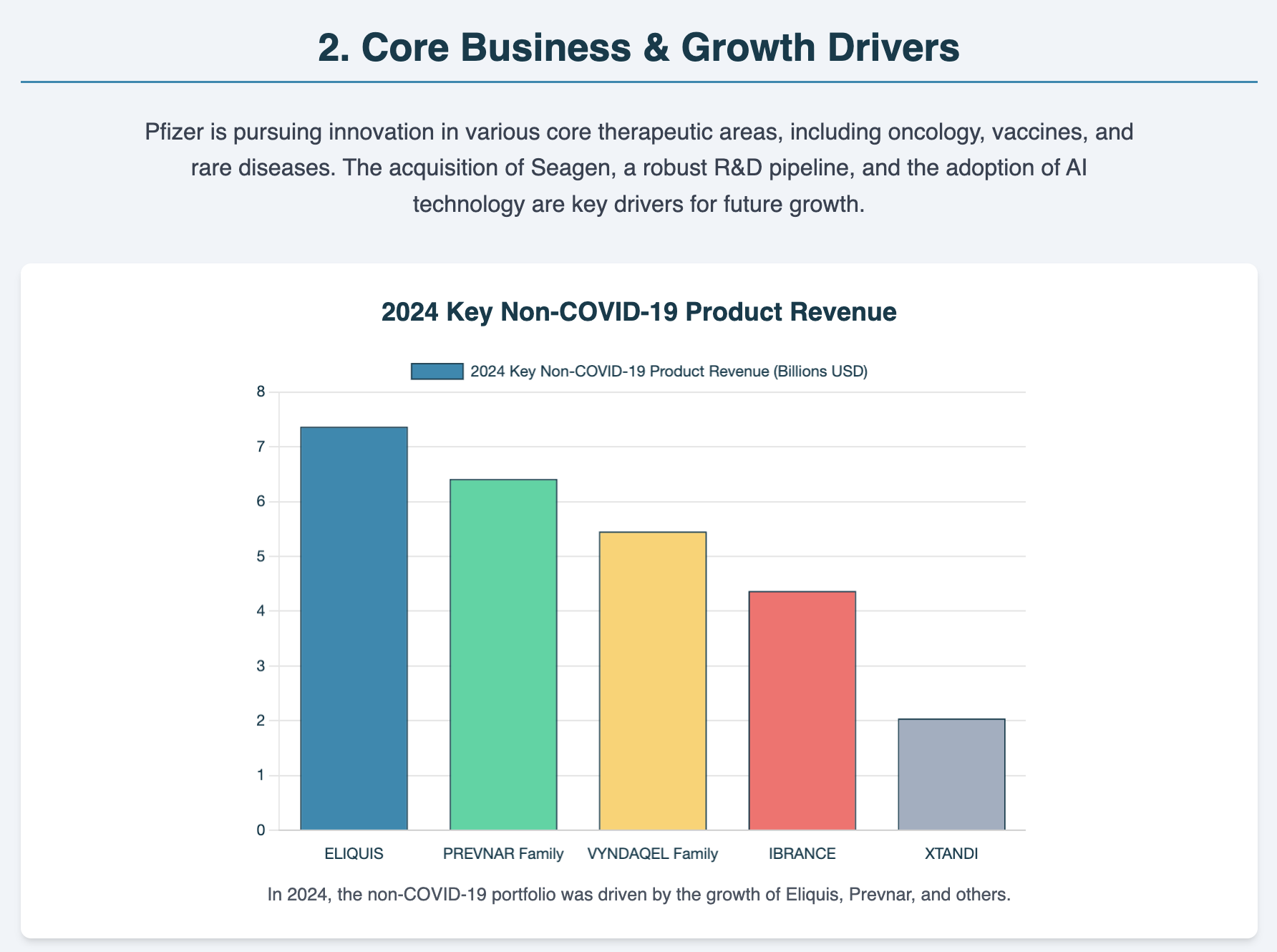

2024 Major Revenue Source Analysis

Pfizer's portfolio is more diversified than expected:

- ELIQUIS (Anticoagulant): $7.4 billion (12%)

- PREVNAR (Pneumococcal Vaccine): $6.4 billion (10%)

- VYNDAQEL (Rare Disease Treatment): $5.5 billion (9%)

- IBRANCE (Oncology): $4.4 billion (7%)

With significantly reduced COVID-19 product dependency, 82.6% of total revenue consists of non-COVID-19 products.

2. Game Changer: Seagen Acquisition and Future Growth Strategy

Seagen Acquisition Impact

Seagen Acquisition Impact

The $43 billion Seagen acquisition is the largest bet in Pfizer's history.

Why invest such a large amount?

-

Double oncology pipeline: Pfizer aims to launch 8 blockbuster oncology drugs by 2030 with the ambitious goal of "ending cancer"

-

Acquiring ADC (Antibody-Drug Conjugate) technology: Core of next-generation cancer treatment technology

-

Immediate 2024 impact: Seagen contributed $3.4 billion in revenue

AI-Based Drug Development Revolution

Pfizer aims to reduce drug development costs by 40% with AI and shorten development time from 5 years to 12-18 months.

Major events scheduled for 2025:

- 13 Phase 3 clinical trials to begin

- 8 late-stage results to be announced

- 4 regulatory approvals expected

Notably, obesity treatment danuglipron development is also underway. As an oral GLP-1 agent taken once daily, if successful, it could become a game changer competing with Novo Nordisk or Eli Lilly.

3. Financial Health: Cash Flow and Profitability Review

Pfizer Cash Flow Analysis

Pfizer Cash Flow Analysis

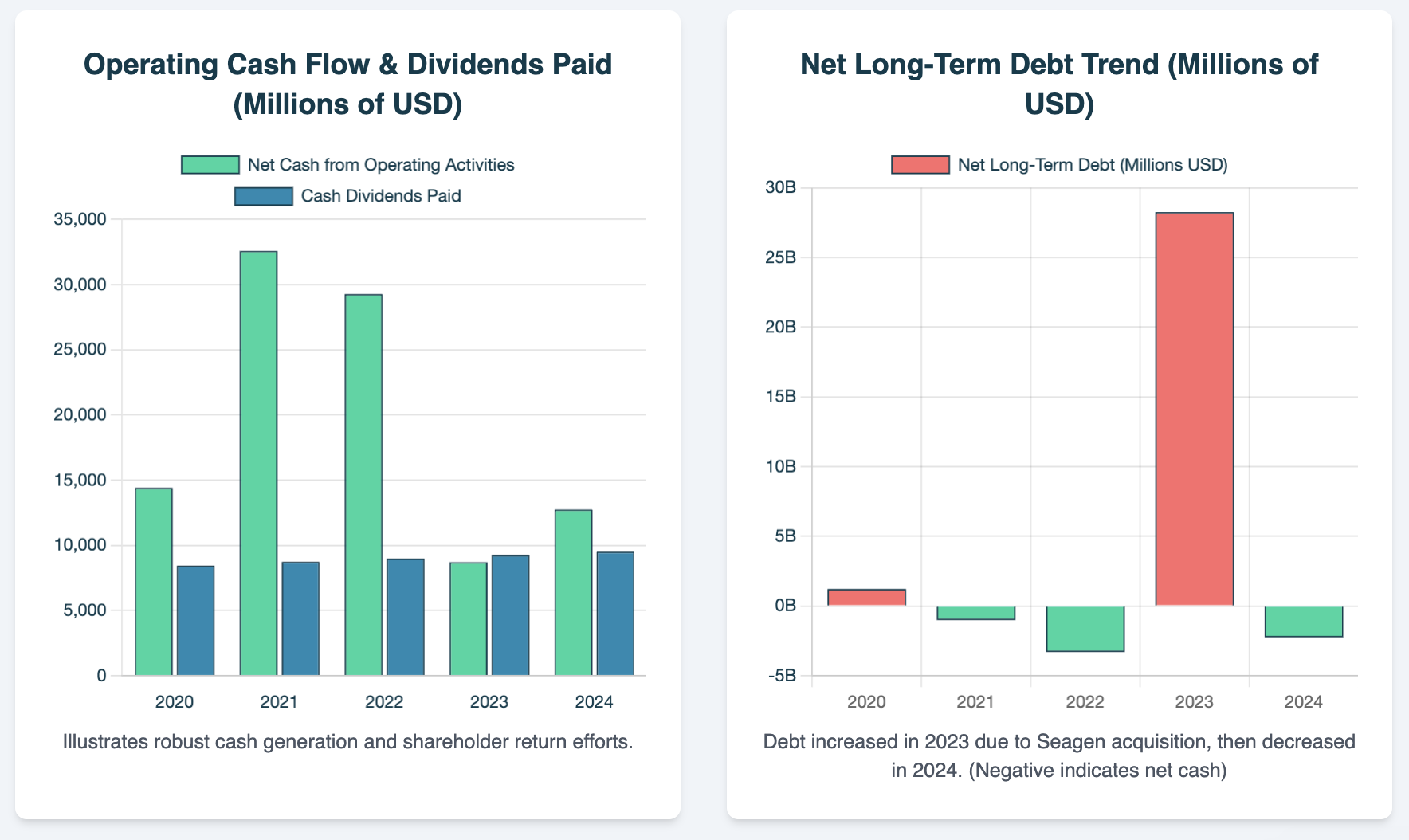

Recovery of Cash Generation Capacity

2024 operating cash flow recovered to $12.7 billion, stably covering dividend payments of $9.5 billion.

Key points:

- R&D Investment: $10.8 billion (future growth driver)

- Dividend Payments: Maintaining steady growth trend

- Debt Repayment: $7.8 billion repaid in 2024, improving financial health

Pfizer Profitability Trends

Pfizer Profitability Trends

Proper Interpretation of Profitability Metrics

2023 reported net income plunged to $2.1 billion, but this was due to one-time accounting adjustments.

Based on adjusted net income:

- 2024: $17.7 billion (Adjusted EPS $3.11)

- 2023: $10.5 billion (Adjusted EPS $1.84)

69% increase in 2024, showing significantly improved actual operating performance.

4. Competitive Environment: The Massive Challenge of 'Patent Cliff'

Market Competition Situation

Market Competition Situation

$236 Billion 'Patent Cliff'

The biggest threat facing the entire pharmaceutical industry between 2025-2030. Approximately 70 high-revenue drugs will lose patents, with expected revenue loss of $236 billion.

Products Pfizer must particularly watch:

- ELIQUIS: April 2028 (2024 revenue $7.4 billion)

- PREVNAR: Major patents expire in 2026

- IBRANCE: Expires in 2027

- XTANDI: Expires in 2027

Industry Innovation Trends

AI and Digitalization: Maximizing drug development efficiency

Precision Medicine: Expansion of personalized treatments

Focus on High-Growth Areas: Oncology expected to account for 27% of total pharmaceutical revenue by 2030

Pfizer's response strategy is precisely the Seagen acquisition and AI investment. The strategy is to replace revenue lost from patent expiration with innovative oncology drugs.

5. Policy Risk: U.S. Government Drug Pricing Pressure

Policy Environment Impact

Policy Environment Impact

Dual Pressure of Drug Price Reduction Policies

1. Inflation Reduction Act (IRA)

- Pfizer's ELIQUIS included in first 10 price negotiation targets

- Negotiated lower prices to apply from 2026

2. 'Most Favored Nation (MFN)' Pricing Policy

- Policy to lower U.S. drug prices to other developed country levels

- Industry-wide concern of $1 trillion revenue loss

Manufacturing Reshoring Policy Contradiction

The U.S. government is asking to lower drug prices while simultaneously increasing domestic production.

- Increased domestic production costs vs Drug price reduction pressure

- Complex strategic challenge for global companies like Pfizer

Fortunately, Pfizer's initial exposure to MFN policy is more limited than some competitors, and continuous cost reduction efforts are expected to provide some cushioning effect.

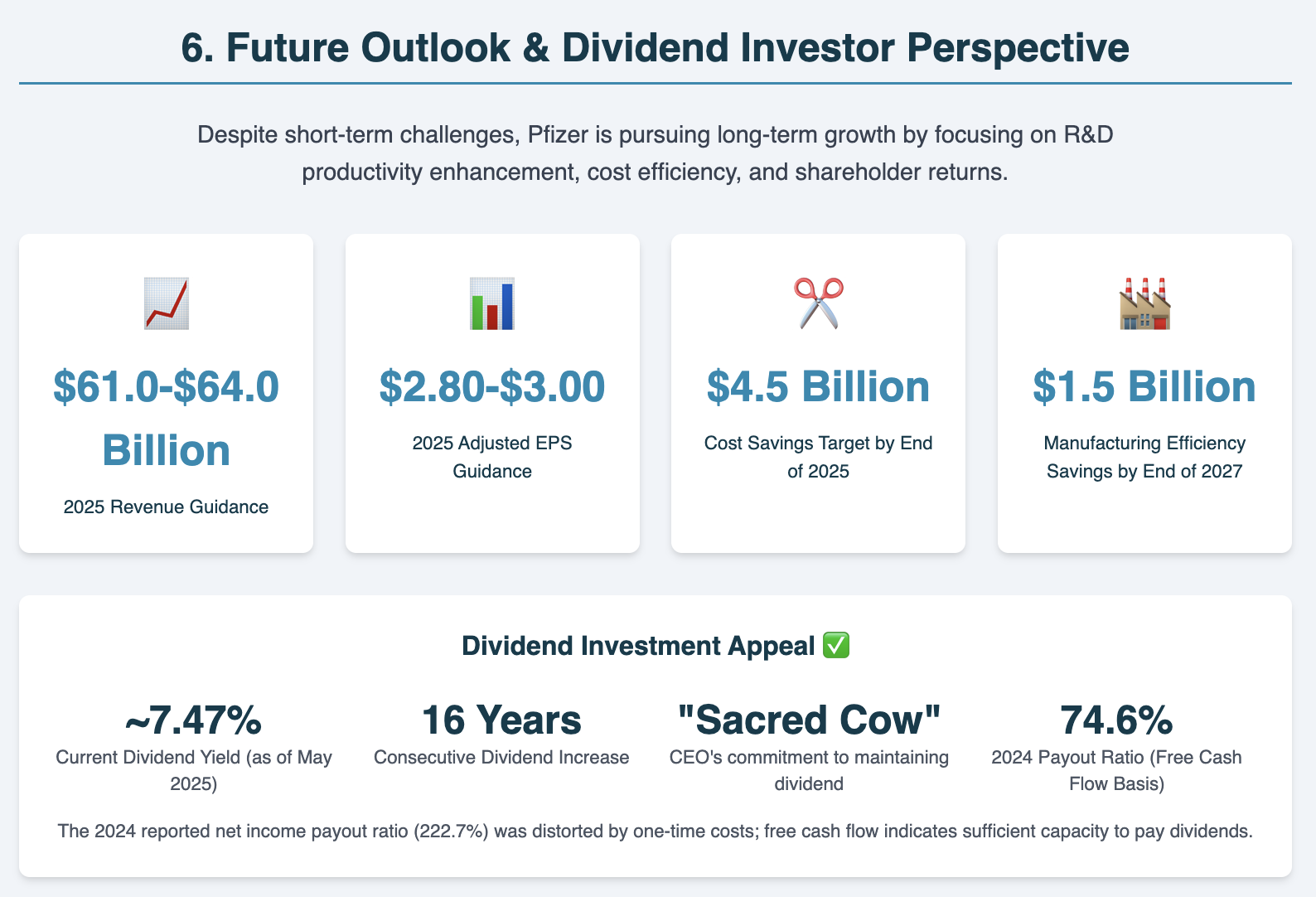

6. Dividend Investor Perspective: Is Now an Opportunity?

Pfizer Dividend Analysis

Pfizer Dividend Analysis

Dividend Status and Sustainability

Current dividend attractiveness:

- Annual dividend: $1.72 per share (quarterly $0.43)

- Dividend yield: 7.47% (as of May 2025)

- Consecutive increases: 16 consecutive years of dividend increases

- CEO's commitment: Described dividend as "sacred cow"

Dividend stability indicators:

- 2024 free cash flow: $9.8 billion

- Dividend payments: $9.5 billion

- Cash flow-based payout ratio: 74.6% (healthy level)

Note: The 2024 reported net income-based payout ratio of 222.7% is distorted by one-time costs, and dividend payment capacity based on free cash flow is sufficient.

Pfizer Future Outlook

Pfizer Future Outlook

2025 Outlook and Growth Drivers

2025 Guidance:

- Revenue: $61-64 billion

- Adjusted EPS: $2.80-3.00

- Cost savings: $4.5 billion target by end of 2025

- Manufacturing efficiency: Additional $1.5 billion savings by 2027

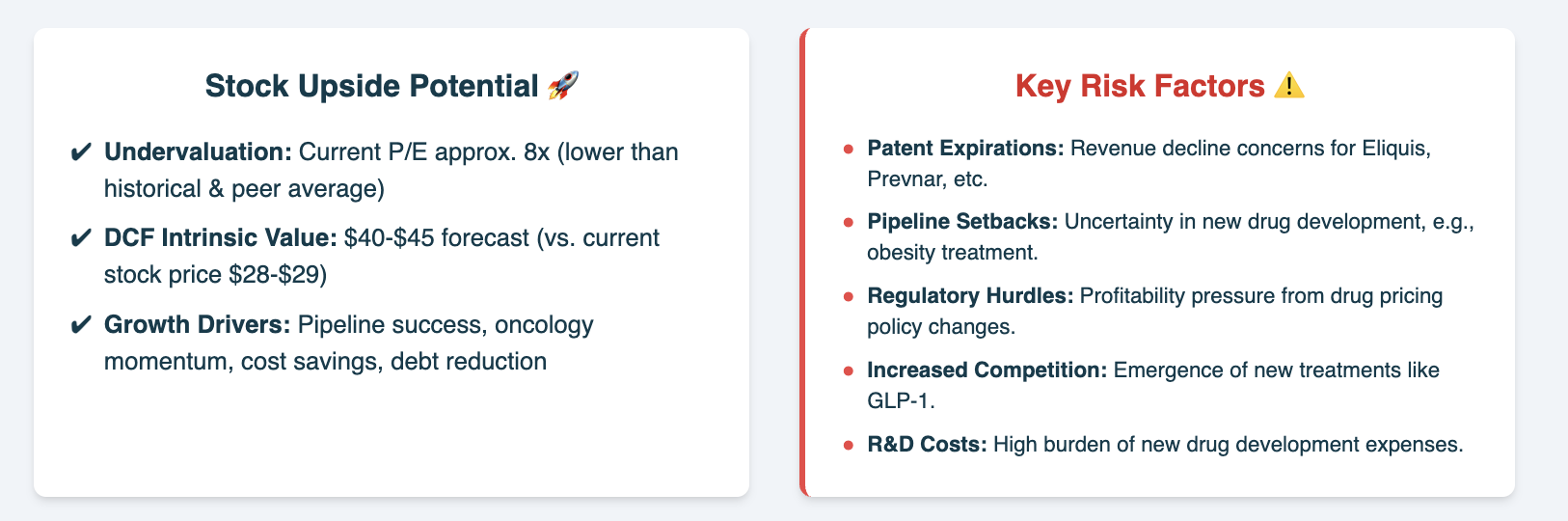

Stock Price Upside Potential

Current valuation: P/E ratio approximately 8x (undervalued compared to historical average and peer group)

DCF intrinsic value: $40-45 (significant discount to current stock price of $28-29)

Upside catalysts:

✅ Pipeline clinical trial success

✅ Oncology sector momentum

✅ Visible cost reduction effects

✅ Debt reduction completion

Major risk factors:

🔴 Major product revenue decline due to patent expiration

🔴 Pipeline setbacks (obesity treatment, etc.)

🔴 Regulatory obstacles (drug pricing policies)

🔴 Intensified competition (new GLP-1 treatments, etc.)

Conclusion: Attractive Entry Point for Long-term Dividend Investors

💡 Investment Point Summary

Current situation facing Pfizer:

- Temporary stock price correction due to COVID-19 revenue normalization

- Structural challenge of major drug patent expiration

- U.S. government drug price reduction policy pressure

Reasons why it's still attractive:

- 16 consecutive years of dividend increases - firm dividend policy

- 7.47% high dividend yield and stable cash flow

- Future growth foundation through $43 billion Seagen acquisition

- Efficiency improvement through $4.5 billion cost savings

- Currently undervalued valuation

🎯 Who is this investment suitable for?

Recommended for:

- Long-term dividend investors: High dividend yield and consistent increase history

- Value investors: Attractive entry point at currently discounted price

- Retirement planners: Stable cash flow and dividend sustainability

Caution for:

- Short-term profit seekers: Short-term volatility expected due to patent expiration issues

- Growth stock preferrers: Explosive growth limited due to pharmaceutical industry characteristics

📊 Final Assessment

Pfizer is a dividend stock that can provide long-term value despite short-term headwinds.

Current difficulties are mostly temporary or predictable, and the company is implementing specific and proactive countermeasures.

Considering the 7.47% high dividend yield, 16 consecutive years of dividend increases track record, and management's firm commitment that "dividends are a sacred cow", this can be an attractive opportunity for long-term dividend investors.

However, it's important to continuously monitor patent expiration schedules and pipeline progress before investing.